Comprehensive Guide to Taxi Top LED Display Price: Factors, Trends, and Industry Insights

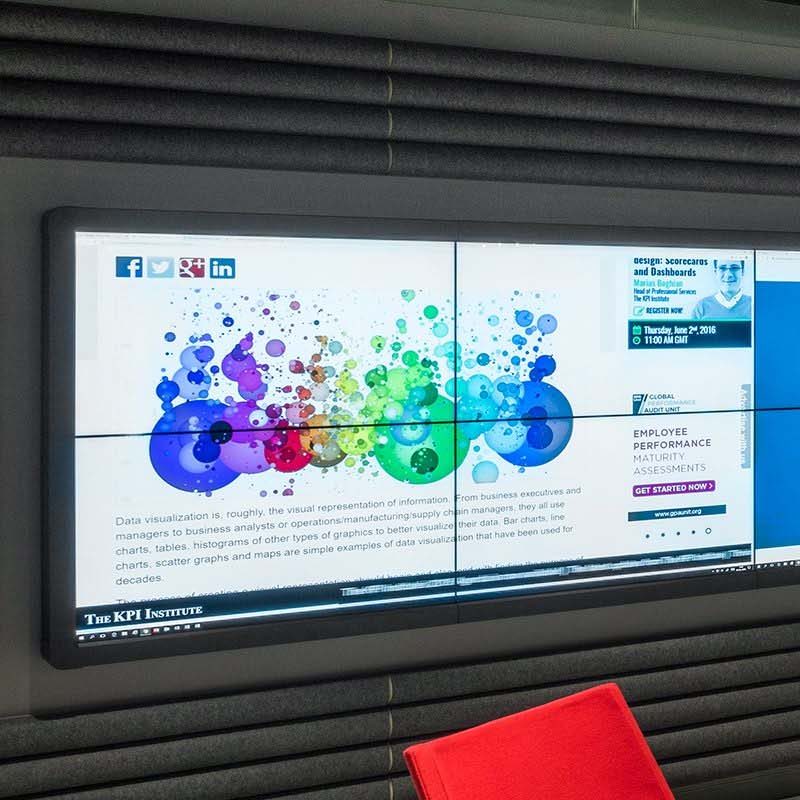

Taxi top LED displays have emerged as a dynamic advertising medium, revolutionizing urban marketing strategies worldwide. These high-brightness, sunlight-readable LED screens mounted atop commercial vehicles like taxis serve as mobile billboards, delivering targeted messaging to pedestrians, motorists, and commuters. Given the global proliferation of digital out-of-home (DOOH) advertising, understanding taxi top LED display price dynamics is crucial both for fleet operators and advertisers who seek to optimize return on investment (ROI).

Introduction

The evolution of LED technology combined with the rising demand for interactive, real-time advertisements has propelled taxi top LED displays into a powerful advertising tool. However, for industry participants contemplating the acquisition or deployment of these displays, cost remains a pivotal consideration. This comprehensive guide delves into the various factors influencing taxi top LED display pricing, distinguishes between segments in the marketplace, and examines emerging trends and common technical challenges relevant to this sector.

Understanding Taxi Top LED Display Pricing Landscape

Taxi top LED display prices vary widely based on a combination of technical specifications, manufacturing quality, and additional features. Typically, the price range for a standard 48″ to 55″ LED display module for a taxi roof can be anywhere between USD 2,500 and 10,000, but several elements contribute to this variation.

1. Display Technology and Resolution

The heart of any LED display is its pixel pitch—the distance between individual LED diodes. Smaller pixel pitches provide higher resolution and sharper image quality but at a higher cost due to the increased density of LEDs and complex manufacturing. For taxi top displays, popular pixel pitches fall between 4mm to 10mm:

- 4mm to 6mm pixel pitch: Offers HD resolution suited for close-range visibility. Ideal for densely populated urban environments.

- 7mm to 10mm pixel pitch: More cost-effective and optimized for medium-range viewing.

Higher resolution modules lead to increased pricing not just for the LED panel but also for necessary driver ICs, controllers, and processing units.

2. Brightness and Sunlight Readability

Taxi top LED displays must maintain visibility under direct sunlight, often exceeding 5,000 nits of brightness. High-brightness LED modules, equipped with advanced LEDs and effective optical layers like anti-glare coatings, can command higher prices. Brightness also impacts energy consumption, thus indirectly influencing operational costs.

3. Display Size and Configuration

The physical dimensions of the display, custom housings, and integration features affect manufacturing complexity. Slim, aerodynamic designs reduce taxi roof drag but may increase structural engineering costs. Dual-sided LED displays enable visibility from multiple angles but increase material costs substantially.

4. Weatherproof and Durability Standards

Given their outdoor mobile nature, taxi LED displays require robust weatherproofing. Enclosures typically conform to at least IP65 water/dust resistance standards. Compliance with automotive vibration resistance, UV radiation tolerance, and temperature range certifications adds to manufacturing costs. Use of aerospace-grade aluminum alloys or carbon fiber reinforcement panels also influences pricing.

5. Control Systems and Connectivity

Modern taxi top displays integrate cloud-based content management systems (CMS), enabling dynamic content updates, GPS-based targeting, and real-time analytics. The inclusion of 4G/5G wireless modules, edge computing devices, and AI-driven programmatic advertising significantly raises the initial expense but offers superior functionality and monetization potential.

6. Regulatory Compliance and Certification

In different jurisdictions, LED advertising on vehicles is regulated for safety and distraction concerns. Manufacturers often include certifications for electromagnetic compatibility (EMC), road safety impact assessments, and local transport authority approvals. Compliance costs factor into the final purchase price.

Market Benchmarking: Pricing Across Global Regions

Pricing is also affected by geographic market dynamics influenced by manufacturing hubs, labor costs, tariffs, and distributor markups. For instance:

- China: As the largest manufacturer of LED components and displays, Chinese vendors offer competitive pricing. Standard taxi top LED displays from Tier 1 factories range from USD 3,000 to 7,000 per unit, often bundled with CMS platforms.

- Europe and North America: Premium displays with stringent certifications and advanced durability features command prices upwards of USD 7,000 to 12,000.

- Emerging Markets: Lower-spec, locally assembled LED displays may cost between USD 2,500 and 4,500 but often trade off on brightness or feature richness.

Practical Applications and ROI Considerations

Operators invest in taxi top LED displays either for advertising revenue generation or enhanced fleet branding. The ability to display dynamic ads based on location, time, or audience demographics increases campaign effectiveness, driving higher CPM (cost per mille) rates for advertisers.

Case Study: A fleet in Singapore deployed 500 taxi top LED displays equipped with 5G CMS and geotargeting. The fleet’s ad revenue grew by 35% within 6 months, clearly validating the business case for paying a premium on initial display pricing in exchange for advanced features and higher brightness modules.

Common Challenges Impacting Pricing and Usage

While the technology is mature, several challenges impact pricing and operational costs:

- Power Consumption: High-brightness displays require significant power, necessitating additional vehicle battery capacity or external power sources, adding to total cost of ownership.

- Maintenance and Serviceability: LED panels mounted on moving vehicles are exposed to shocks, weathering, and vandalism, leading to periodic maintenance that must be factored into lifecycle costs.

- Content Management Complexity: Sophisticated CMS platforms with real-time analytics require ongoing subscription fees beyond hardware costs.

- Legal Restrictions: Variations in local regulations dictate permissible brightness and display content types, sometimes requiring costly compliance retrofits.

Emerging Trends Shaping the Future of Taxi Top LED Displays

- AI and Programmatic Advertising: Integration of machine learning algorithms optimizes ad selection in real-time, enabling dynamic pricing models and better audience engagement.

- Energy-Efficient LEDs: Adoption of COB (chip-on-board) LED technology and better thermal management reduces power draws, lowering operational costs without sacrificing brightness.

- Flexible and Transparent Displays: Innovations in flexible LED panels open opportunities for curved or aerodynamic designs that blend better with taxi rooftops, potentially influencing price by reducing structural reinforcement needs.

- 5G Connectivity: Accelerated rollout of 5G networks enables higher bandwidth content delivery and faster CMS updates, making displays more responsive and versatile.

Industry Standards and Best Practices

Well-established industry standards govern aspects of taxi top LED displays:

- IEC 60598-1: Safety standards for luminaires applied to LED modules to ensure electrical and fire safety compliance.

- IP Ratings: Minimum IP65 ingress protection is recommended for outdoor, vehicle-mounted displays.

- EMC Compliance: EN 55032 and FCC Part 15 ensure electromagnetic compatibility especially important for urban environments.

- Brightness Standards: Taxi top displays commonly target >5,000 nits, per guidance from bodies like the Illuminating Engineering Society (IES).

Conclusion

Determining the right taxi top LED display price involves balancing technical specifications, regulatory requirements, and feature sets against budget constraints and business objectives. High-brightness, sunlight-readable taxi top LED displays vary significantly in price depending on resolution, durability, control systems, and geographic considerations.

For fleet owners and advertisers alike, investing in robust, high-quality LED displays backed by advanced CMS platforms yields measurable ROI through amplified advertising revenue and stronger brand presence. Staying abreast of rapidly evolving technologies such as AI-driven content management, energy-efficient components, and 5G connectivity will help stakeholders make informed purchasing decisions and future-proof their investments.

By carefully analyzing manufacturer offerings, engaging reputable suppliers compliant with international standards, and aligning display features with operational conditions, clients can optimize costs while leveraging the tremendous marketing potential of taxi top LED displays in today’s competitive outdoor advertising landscape.

References:

- Wikipedia contributors. “LED display.” Wikipedia, The Free Encyclopedia. https://en.wikipedia.org/wiki/LED_display

- International Electrotechnical Commission. IEC 60598-1: Luminaires – Part 1: General requirements and tests.

- Illuminating Engineering Society (IES). Lighting Handbook.

- FCC Part 15: Radio Frequency Devices.

- Market study reports, Global Digital Out-of-Home Advertising Market 2023-2030.

- Case studies from Asia Outdoor Media Alliance (AOMA) on taxi top LED deployment and advertising effectiveness.